Dollar General (DG)

147.16

+0.00 (0.00%)

NYSE · Last Trade: Feb 12th, 9:23 AM EST

DOLLAR GENERAL CORP (NYSE:DG) Emerges as a Top Technical Breakout Candidatechartmill.com

Via Chartmill · February 12, 2026

The American economy finds itself balanced on a precarious ledge as of early 2026. New data from the Federal Reserve Bank of New York reveals that total U.S. household debt has surged to a staggering $18.8 trillion, a record high that reflects the growing reliance of American families

Via MarketMinute · February 11, 2026

Strong dividend-paying companies can reduce volatility.

Via The Motley Fool · February 11, 2026

Realty Income is a more sensible income investment.

Via The Motley Fool · February 10, 2026

Dollar Tree Stock Slides Nearly 3% As BNP Warns Of Slowing Sales Momentumstocktwits.com

Via Stocktwits · January 21, 2026

While Dollar General stock has outpaced the broader market over the past year, analysts remain fairly bullish about its prospects.

Via Barchart.com · February 10, 2026

Today, February 9, 2026, marks a watershed moment for The Kroger Co. (NYSE: KR). After nearly two years of regulatory paralysis, a failed multi-billion dollar merger, and a leadership vacuum following the sudden departure of its long-time chief executive, the nation’s largest traditional grocer has signaled a definitive "new chapter." The appointment of Greg Foran—the [...]

Via Finterra · February 9, 2026

These dividend stocks are worthy of income investors' attention.

Via The Motley Fool · February 9, 2026

A company that generates cash isn’t automatically a winner.

Some businesses stockpile cash but fail to reinvest wisely, limiting their ability to expand.

Via StockStory · February 5, 2026

In a sharp reversal of the optimistic momentum seen at the end of last year, U.S. consumer confidence has tumbled to an eight-month low, with the Conference Board’s Consumer Confidence Index falling to 98.3 in January 2026. This decline marks a significant psychological shift among American households,

Via MarketMinute · February 5, 2026

These stocks may not bring about excitement, but they will generate considerable amounts of dividend income.

Via The Motley Fool · February 4, 2026

The S&P 500 (^GSPC) is home to the biggest and most well-known companies in the market, making it a go-to index for investors seeking stability.

But not all large-cap stocks are created equal - some are struggling with slowing growth, declining margins, or increased competition.

Via StockStory · February 2, 2026

As the 2026 tax filing season begins, the American economy is navigating a radical transformation defined by Treasury Secretary Scott Bessent’s "non-inflationary boom" strategy. This ambitious economic experiment, centered on the "One Big Beautiful Bill" (OBBB)—officially the Working Families Tax Cut Act—represents the most significant shift in

Via MarketMinute · January 28, 2026

American consumer confidence plummeted in January 2026, reaching its lowest level in over a decade as the combined weight of political instability in Washington and persistent inflationary pressures took a heavy toll on household outlooks. The Conference Board reported on Tuesday that its Consumer Confidence Index fell to 84.5,

Via MarketMinute · January 28, 2026

Elevated inflation is sending consumers across the income spectrum to discount stores.

Via The Motley Fool · January 27, 2026

As the financial world closes the books on January 2026, market participants are casting a wary eye toward the upcoming February economic calendar. One year ago, the University of Michigan Consumer Sentiment Index recorded a staggering drop to 64.7, a figure that has since become a benchmark for the

Via MarketMinute · January 27, 2026

As the opening bell rang on January 26, 2026, the equity markets found themselves at a historic crossroads. J.P. Morgan Global Research has issued a stark warning regarding the unprecedented concentration of the S&P 500, revealing that the top 20 stocks now command a staggering 50.8% of

Via MarketMinute · January 26, 2026

E.l.f. Beauty's stock is down, but the company has a lot of opportunities.

Via The Motley Fool · January 25, 2026

The bank’s head of equity strategy, Dubravko Lakos-Bujas, said that President Trump is likely to increase affordability efforts ahead of the midterm election season.

Via Stocktwits · January 23, 2026

Via MarketBeat · January 23, 2026

Dollar General is gearing up to report its fourth-quarter results soon, and analysts are expecting a single-digit decline in earnings.

Via Barchart.com · January 23, 2026

Discount retailer, Dollar General Corp. (NYSE: DG), is set to pay shoppers across its 20,000 nationwide outlets, as part of its "deceptive" pricing class action settlement.

Via Benzinga · January 23, 2026

As the morning bell rang on Wall Street this Thursday, January 22, 2026, the Department of Labor released a set of figures that have sent economists back to their spreadsheets. Initial jobless claims for the week ending January 17 rose slightly to 200,000, up from a revised 199,000

Via MarketMinute · January 22, 2026

If you're searching for income and stability, here are three excellent dividend stocks.

Via The Motley Fool · January 20, 2026

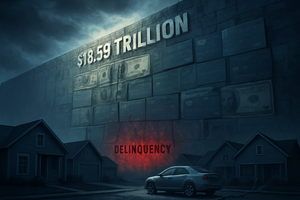

As of January 20, 2026, the American consumer is navigating a financial landscape defined by a staggering milestone: total household debt has officially surged past the $18 trillion mark, settling at a record $18.59 trillion. While the headline figure represents a massive expansion of credit, the underlying data reveals

Via MarketMinute · January 20, 2026