Latest News

As the closing bell approaches for the final quarter of fiscal year 2026, all eyes in the technology sector are fixed on Dell Technologies (NYSE:DELL). Scheduled to report its fourth-quarter results on Thursday, February 26, 2026, the Round Rock, Texas-based giant is expected to showcase a massive surge in

Via MarketMinute · February 23, 2026

WASHINGTON D.C. — In a dramatic shift of the global economic landscape, the United States is currently witnessing a massive "repatriation" of industrial capacity, commonly referred to as the US Manufacturing Renaissance. As of February 23, 2026, over $3 trillion in reshoring-related investments have been announced since early 2025, driven

Via MarketMinute · February 23, 2026

Via Talk Markets · February 23, 2026

Via Benzinga · February 23, 2026

The dream of a "pivot" to lower interest rates in early 2026 has been dealt a staggering blow following the release of the latest Personal Consumption Expenditures (PCE) price index. On February 23, 2026, investors are grappling with data that confirms inflation is not merely "sticky" but potentially re-accelerating, forcing

Via MarketMinute · February 23, 2026

Kaiser Aluminum (KALU) Q4 2025 Earnings Transcript

Via The Motley Fool · February 23, 2026

As of February 23, 2026, the global retail landscape is reeling from a weekend of unprecedented trade policy shifts. Following a landmark Supreme Court ruling on Friday that initially appeared to offer a reprieve for importers, the executive branch moved swiftly to impose a new 15% global import surcharge. This

Via MarketMinute · February 23, 2026

Ascendis (ASND) Q4 2025 Earnings Call Transcript

Via The Motley Fool · February 23, 2026

As of February 23, 2026, the S&P 500 (INDEXSP: .INX) finds itself at a critical crossroads, grappling with a formidable horizontal resistance level at the 6,900 mark. After a blistering start to the year that saw the index flirt with the psychological 7,000 milestone, the momentum has

Via MarketMinute · February 23, 2026

Analysts on Monday pounded the table for three analog chip stocks after their fourth-quarter earnings reports, including STM stock.

Via Investor's Business Daily · February 23, 2026

Via Benzinga · February 23, 2026

BRUSSELS — In a dramatic escalation of global trade tensions, the European Parliament officially voted on February 23, 2026, to halt the ratification of the "Turnberry Agreement," a landmark trade deal intended to stabilize the multitrillion-dollar economic relationship between the European Union and the United States. The suspension follows a week

Via MarketMinute · February 23, 2026

Here's one stock actually worth buying amid this market pullback.

Via The Motley Fool · February 23, 2026

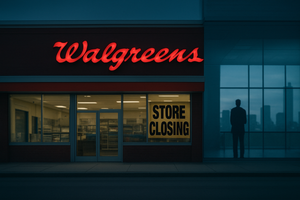

DEERFIELD, IL — February 23, 2026 — In a move that underscores the continued volatility of the American retail pharmacy landscape, the newly private Walgreens Boots Alliance has announced a significant expansion of its workforce reductions and a finalized timeline for its massive store closure initiative. Under the leadership of the private

Via MarketMinute · February 23, 2026

The company announced the milestone in a post on social media platform X.

Via Stocktwits · February 23, 2026

Via MarketBeat · February 23, 2026

Apple stock might avoid the worst of the "AI bubble" or "tech sell-off" narratives.

Via The Motley Fool · February 23, 2026

Six Flags operates amusement and water parks across North America, leveraging branded attractions to drive guest engagement and revenue.

Via The Motley Fool · February 23, 2026

In a move that marks the end of the traditional x86 processor's decades-long dominance, Nvidia (NASDAQ:NVDA) today officially unveiled its N1 and N1X series of AI-powered laptop processors. Announced at the 2026 AI Mobile Summit in Barcelona, these chips represent Nvidia’s first comprehensive push into the consumer System-on-a-Chip

Via MarketMinute · February 23, 2026

Another day, another price target reduction.

Via The Motley Fool · February 23, 2026

The aviation sector faced a brutal start to the week as a massive winter storm, dubbed "Winter Storm Fernando" by meteorologists, tore through the Northeast United States on February 23, 2026. Characterized as a "bomb cyclone," the storm brought historic snowfall and high winds to the I-95 corridor, forcing the

Via MarketMinute · February 23, 2026

Federal Reserve Governor Christopher Waller delivered a sobering message to financial markets on February 23, 2026, signaling that the central bank is likely to skip a widely anticipated interest rate cut at its upcoming March meeting. Speaking at the National Association for Business Economics (NABE) conference, Waller cited a surprisingly

Via MarketMinute · February 23, 2026

The undisputed reign of Novo Nordisk in the weight-loss drug sector faced its most severe challenge to date on February 23, 2026, as the company’s US-traded shares (NYSE: NVO) plummeted 15.1% in a single session. The massive sell-off, which erased approximately $100 billion in market capitalization, was triggered

Via MarketMinute · February 23, 2026

ANN ARBOR, MI – In a powerful display of consumer resilience and operational efficiency, Domino’s Pizza, Inc. (NYSE: DPZ) reported fourth-quarter 2025 financial results this morning that comfortably cleared Wall Street’s expectations for revenue and domestic growth. The pizza giant’s performance was bolstered by a resurgent U.S.

Via MarketMinute · February 23, 2026

A report from Forge Global stated that AI infrastructure company Lambda might be seeking an IPO in "an unfriendly environment."

Via Benzinga · February 23, 2026

Via Talk Markets · February 23, 2026

DraftKings shares fall as the company prepares for its March 2 Investor Day, at which management may update FY28 revenue and EBITDA guidance.

Via Benzinga · February 23, 2026

Via Benzinga · February 23, 2026

SAN FRANCISCO — February 23, 2026 — OpenAI has officially moved from providing the world’s most popular large language models to becoming the central nervous system of global business. In a series of landmark multi-year agreements announced today, the AI powerhouse unveiled the "Frontier Alliances"—a strategic partnership with Accenture, Boston

Via MarketMinute · February 23, 2026

The enterprise software market is currently weathering its most volatile period since the 2022 rate hikes, as a massive sell-off—now being dubbed the "SaaSpocalypse"—wipes out nearly $1 trillion in market value. This dramatic recalibration of the technology sector has been catalyzed by fears that OpenAI’s rapid expansion

Via MarketMinute · February 23, 2026

The fintech landscape was jolted on February 23, 2026, as shares of PayPal Holdings, Inc. (NASDAQ: PYPL) surged by 10% following reports of unsolicited takeover interest from a "large rival" and several private equity consortiums. The sudden spike, which briefly triggered a volatility halt in midday trading, has ignited a

Via MarketMinute · February 23, 2026

NEW YORK — In a historic week for global financial markets, precious metals have ascended to unprecedented heights as investors flee traditional equities in favor of "hard assets." On February 23, 2026, gold prices surged to an all-time record of $5,192 per ounce, while silver prices flirted with the $88

Via MarketMinute · February 23, 2026

The winter storm hitting the East Coast Monday led airline stocks to sink while Airbnb and Expedia also fell.

Via Investor's Business Daily · February 23, 2026

Monday's session: most active stock in the S&P500 indexchartmill.com

Via Chartmill · February 23, 2026

The leader of consumer hardware and software is posting impressive growth these days.

Via The Motley Fool · February 23, 2026

WASHINGTON D.C. — In a weekend that has fundamentally reshaped the American economic landscape, President Trump has officially signed an executive proclamation raising global tariffs to a uniform 15%. This aggressive maneuver follows a Friday afternoon bombshell from the Supreme Court, which struck down the administration's previous "reciprocal" tariff framework.

Via MarketMinute · February 23, 2026

Lenders begin to worry about how AI agents could undermine their borrowers.

Via The Motley Fool · February 23, 2026