Circle Internet Group, Inc. Class A Common Stock (CRCL)

60.04

+3.41 (6.02%)

NYSE · Last Trade: Feb 14th, 5:19 PM EST

Lawmakers faced pressure to finalize crypto rules as stablecoin debates and Senate delays held back institutional investment.

Via Stocktwits · February 14, 2026

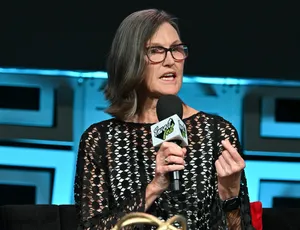

Cathie Wood’s ARK Invest added Robinhood, Bullish, and Circle shares following a volatile trading session.

Via Stocktwits · February 12, 2026

Crypto Stocks Attempt Rebound After Weak Session Amid Bitcoin’s Volatilitystocktwits.com

Via Stocktwits · February 12, 2026

The departure of Gary Gensler and the subsequent appointment of Paul S. Atkins as Chair of the Securities and Exchange Commission (SEC) has signaled a fundamental transformation in U.S. financial regulation. As of February 11, 2026, the era of "regulation by enforcement" that characterized the previous administration has been

Via MarketMinute · February 11, 2026

Coinbase Signals Possible Exit From CLARITY Act Over Stablecoin Incentives: Reportstocktwits.com

Via Stocktwits · January 12, 2026

US Bill Bans Officials' Insider Trading On Prediction Markets After Venezuela’s Nicolás Maduro Arreststocktwits.com

Via Stocktwits · January 10, 2026

Crypto Stocks Under Pressure – HOOD Slumps After Earnings Miss, While COIN And CRCL Drift Lowerstocktwits.com

Via Stocktwits · February 10, 2026

Which of these popular stablecoins has a brighter future?

Via The Motley Fool · February 10, 2026

Investing in stablecoins might be one way to weather the current crypto storm.

Via The Motley Fool · February 9, 2026

The prediction market landscape shifted significantly this week as the world’s leading forecasting platform, Polymarket, officially commenced its transition to native USDC for on-chain settlement. In a strategic partnership with Circle Internet Group (NYSE: CRCL), the move marks the definitive end of the "bridged asset" era for the platform, replacing the older, more vulnerable USDC.e [...]

Via PredictStreet · February 8, 2026

Coinbase Targets 'Everything Exchange' Vision For 2026, CEO Brian Armstrong Saysstocktwits.com

Via Stocktwits · January 2, 2026

Circle Internet Group Inc. (NYSE:CRCL) on Thursday announced a strategic partnership with Polymarket to integrate native USDC

Via Benzinga · February 5, 2026

Other than both companies being in the cryptocurrency space, the shares of Circle and Bullish were trading below their IPO levels.

Via Stocktwits · February 5, 2026

Recent markdowns provide buying opportunities for the iconic growth investor.

Via The Motley Fool · February 3, 2026

XPeng Inc. designs and manufactures smart electric vehicles for tech-focused Chinese consumers, with $10.15B in annual revenue.

Via The Motley Fool · January 30, 2026

Webull Corporation delivers digital trading and wealth management tools for retail investors in the online brokerage sector.

Via The Motley Fool · January 30, 2026

The first month of 2026 is witnessing a transformation in the financial technology sector that few predicted during the "funding winter" of previous years. After a multi-year hiatus in public listings, the fintech IPO market has officially transitioned from a state of hibernation to a "selective resurgence," characterized by a

Via MarketMinute · January 26, 2026

Denver-based Voyager Technologies delivers advanced defense systems and space solutions to government and commercial clients worldwide.

Via The Motley Fool · January 24, 2026

This electric aviation company develops aircraft, propulsion systems, and charging solutions for commercial and defense markets.

Via The Motley Fool · January 24, 2026

Stablecoins aren't supposed to make you money. So how do you pick the right one?

Via The Motley Fool · January 24, 2026

Strategy rose as crypto stocks slid, gold and silver hit records, liquidations jumped, yet analysts still see long-term upside for Bitcoin.

Via Stocktwits · January 24, 2026

Circle Internet Group is the issuer of the second-largest stablecoin in the world -- USDC.

Via The Motley Fool · January 22, 2026

Kraken-linked SPAC KRAKacquisition files for a $250M Nasdaq IPO under KRAQU, with no merger target yet identified.

Via Stocktwits · January 13, 2026

With $51.8 billion, Circle's USD Coin (USDC) ranks second, followed by Sky (SKY) at $10.1 billion. However, the leader remains Tether.

Via Stocktwits · January 5, 2026