ProShares Ultra VIX Short Term Futures ETF (UVXY)

40.59

+0.00 (0.00%)

NYSE · Last Trade: Feb 17th, 5:11 AM EST

The artificial intelligence sector is showing critical warning signs that suggest a significant correction may be approaching.

Via Benzinga · September 25, 2025

Volatility ETFs UVIX, UVXY, VXX, and VIXY rank among 2025's worst performers as calm markets and futures roll costs weigh heavily on returns.

Via Benzinga · September 18, 2025

September's stock slump has a history. This year, ETFs like SPY, TLT, and VIXY could be at the center as investors hedge against rising volatility.

Via Benzinga · August 29, 2025

Volatility-linked ETFs like VIXY, VXX, and UVXY are gaining appeal as the VIX drops, but could offer big gains if fear returns. Risky but enticing.

Via Benzinga · June 9, 2025

In this video, we break down the Volatility Index—a.k.a. the VIX, also known as the market’s fear gauge—and what it signals for traders and investors.

Via Talk Markets · April 6, 2025

Universa Investments hedge fund, led by billionaire investor Mark Spitznagel, posted a 4,144% return in a single quarter during the COVID-19 market crash in early 2020. Here's a look at how he did it.

Via Benzinga · March 17, 2025

VIX ETFs are popular tools for hedging or speculating on volatility, tracking VIX futures. VIXY, VIXM, VXX, VXZ for short-term plays, SVIX for inverse volatility, UVXY for aggressive traders. Today's drop means gains for SVIX and declines for VXX, VIXY, and UVXY.

Via Benzinga · March 14, 2025

The CBOE VIX, which reflects investors' consensus view of future (30-day) expected stock market volatility, surged nearly 18% on Monday to hit 22.74 as of 2:00 p.m. ET, its highest level since August 2024.

Via Stocktwits · March 10, 2025

Markets in turmoil as trade war fears reignite, S&P 500 loses $1.5 trillion. Use VIX to hedge, consider low-volatility ETFs, and follow trends.

Via Benzinga · March 4, 2025

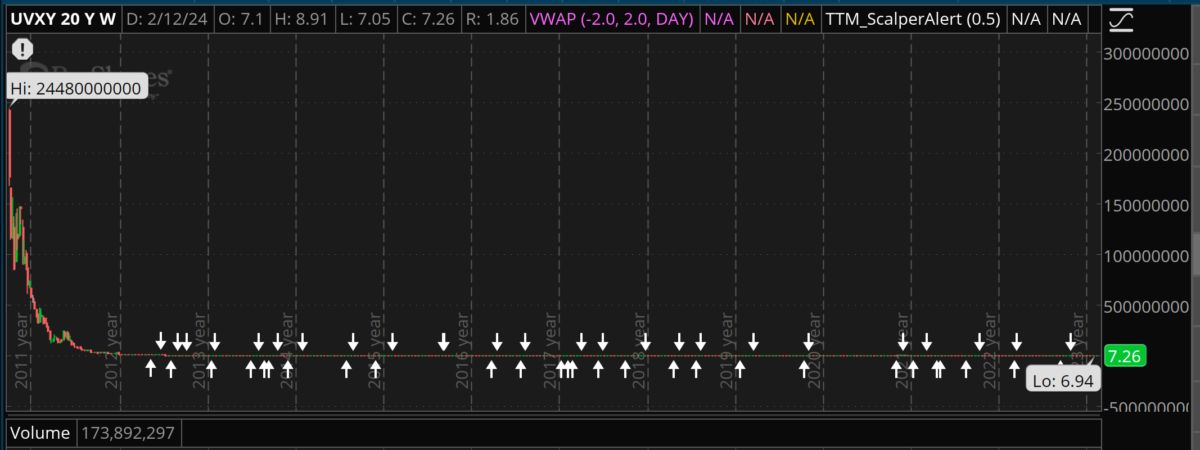

There was a stock that traded at $24,480,000,000 per share on a split adjusted basis back on October 3, 2011. That’s $24.48 billion.

Via Talk Markets · February 16, 2024

Via Benzinga · September 15, 2023

Goldman Sachs analysts raise alarm as the VIX trades below economic indicators. Could volatility be lurking? Explore these insights.

Via Benzinga · September 12, 2023

Discover the jaw-dropping $30,000 bet on the VIX index that could outshine the famous big short. Will Wall Street see another historic upset?

Via Benzinga · September 7, 2023

The SPDR S&P 500 (NYSE: SPY) was rising over 0.5% higher Wednesday after the Bureau of Economic Analysis downwardly revised U.S.

Via Benzinga · August 30, 2023

The SPDR S&P 500 (NYSE: SPY) was surging over 1% higher Tuesday after data released for July showed U.S.

Via Benzinga · August 29, 2023

The ConvexityShares Daily 1x SPIKES Futures ETF (NYSE: SPKX) fell about 5% on Monday, ahead of several key economic data sets, which will offer traders and investors clues as to whether the Federal Reserve will apply another

Via Benzinga · August 29, 2023

Apple, Inc (NASDAQ: AAPL) broke briefly under Thursday’s low-of-day on Friday, after Federal Reserve chair Jerome Powell spoke at the Jackson Hole Symposium and indicated the central bank hasn’t taken more

Via Benzinga · August 25, 2023

The SPDR S&P 500 (NYSE: SPY) was volatile Friday after Federal Reserve chair Jerome Powell’s opening remarks at the Jackson Hole Symposium indicated the central bank may continue to raise interest rates and hold them at a restrictive level until

Via Benzinga · August 25, 2023

The SPDR S&P 500 (NYSE: SPY) opened slightly higher Thursday before running into a group of sellers who knocked the market ETF down from the top of a flag formation, which Benzinga

Via Benzinga · August 24, 2023

The SPDR S&P 500 (NYSE: SPY) was rising about 1% during Wednesday’s trading session, ahead of Nvidia Corporation’s earnings print after the close and the Jackson Hole Symposium,

Via Benzinga · August 23, 2023

The ConvexityShares Daily 1.5x SPIKES Futures ETF (NYSE: SPKY) was spiking up almost 1% higher Tuesday, possibly confirming a new uptrend, which Benzinga pointed out was likely

Via Benzinga · August 22, 2023

The SPDR S&P 500 (NYSE: SPY) was trading about 0.3% lower Friday, popping up briefly from the low-of-day which saw the market ETF open the session down 0.67% amid concerns of

Via Benzinga · August 18, 2023

While the stock market tumbled Thursday, demonstrated by the S&P 500 closing down 0.77%, Bitcoin took a major hit, closing that 24-hour trading session 7.15% lower, amid increased worry the Federal Reserve will continue its rate hike campaign into

Via Benzinga · August 18, 2023

Volatility in the stock market was increasing on Thursday due to major stock indices breaking down through the 50-day moving average, which is a critical support level.

Via Benzinga · August 17, 2023

Nvidia Corporation (NASDAQ: NVDA) was trading near flat on Wednesday, continuing to consolidate Monday’s surge, which saw the stock close that trading session up 8.66%.

Via Benzinga · August 16, 2023