While the S&P 500 is up 13.4% since June 2025, Snowflake (currently trading at $226.40 per share) has lagged behind, posting a return of 5.9%. This may have investors wondering how to approach the situation.

Taking into account the weaker price action, is now a good time to buy SNOW? Find out in our full research report, it’s free for active Edge members.

Why Are We Positive On SNOW?

Named after the unique architecture of its data warehouse which resembles a snowflake pattern, Snowflake (NYSE:SNOW) provides a cloud-based data platform that enables organizations to consolidate, analyze, and share data across multiple cloud providers.

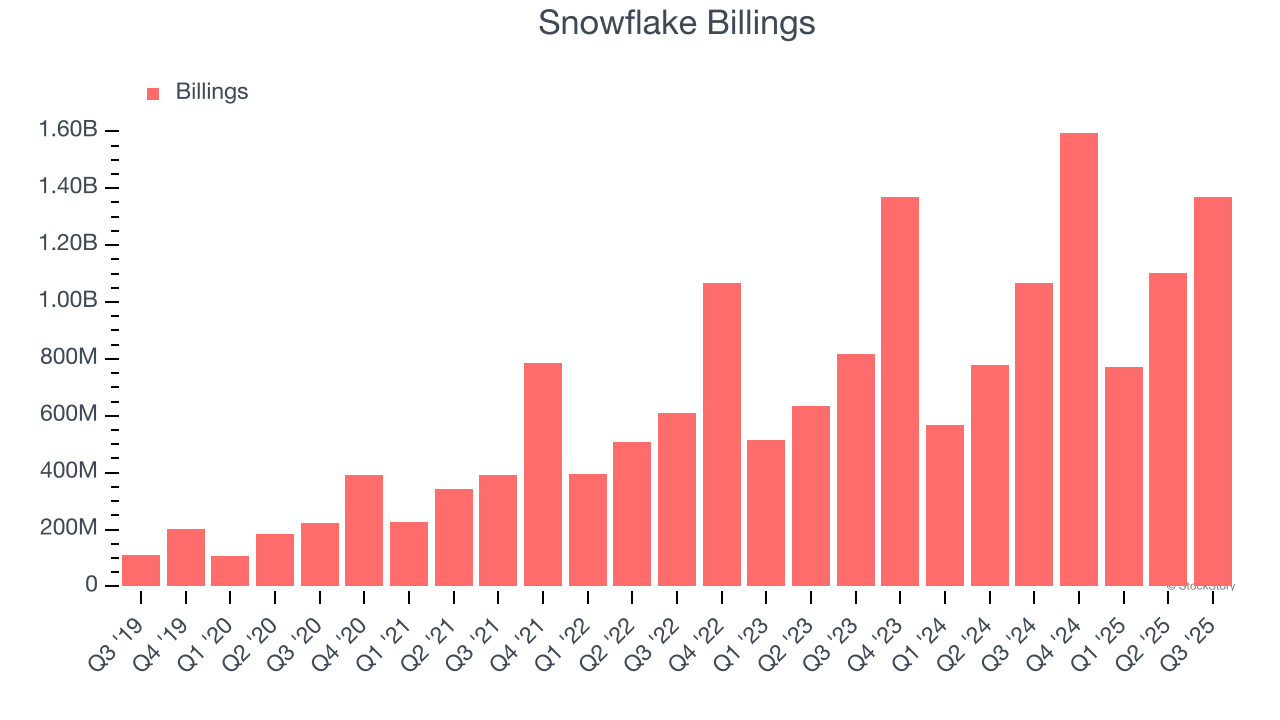

1. Billings Surge, Boosting Cash On Hand

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Snowflake’s billings punched in at $1.37 billion in Q3, and over the last four quarters, its year-on-year growth averaged 30.5%. This performance was fantastic, indicating robust customer demand. The high level of cash collected from customers also enhances liquidity and provides a solid foundation for future investments and growth.

2. Projected Revenue Growth Is Remarkable

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

Over the next 12 months, sell-side analysts expect Snowflake’s revenue to rise by 25.1%. While this projection is below its 29.4% annualized growth rate for the past two years, it is eye-popping and suggests the market is forecasting success for its products and services.

3. Projected Free Cash Flow Gains to Pump Profits

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Over the next year, analysts predict Snowflake’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 17.6% for the last 12 months will increase to 24.6%, giving it more flexibility for investments, share buybacks, and dividends.

Final Judgment

These are just a few reasons Snowflake is a high-quality business worth owning. With its shares underperforming the market lately, the stock trades at 13.8× forward price-to-sales (or $226.40 per share). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free for active Edge members .

High-Quality Stocks for All Market Conditions

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.