Zillow Group (Z) remains well off its recent highs after Alphabet's (GOOG) (GOOGL) Google reportedly tested the placement of sales ads for homes directly in its search results. However, several banks argued that Zillow won't be affected very much by this change, and at least one contended that Google may not be able to continue with the practice. Meanwhile, investment bank Bernstein, which reportedly has the highest price target on the Street for the name, appears to be sticking with its bullish outlook. Bernstein's price target is roughly 50% above the current price of Z stock.

Also importantly, Zillow looks poised to be a big beneficiary of declining interest rates on mortgages.

In light of these points, Z stock could be worth buying on weakness.

About Z Stock

Zillow specializes in hosting ads for homes that are being sold. The firm also sells mortgages and hosts ads for them.

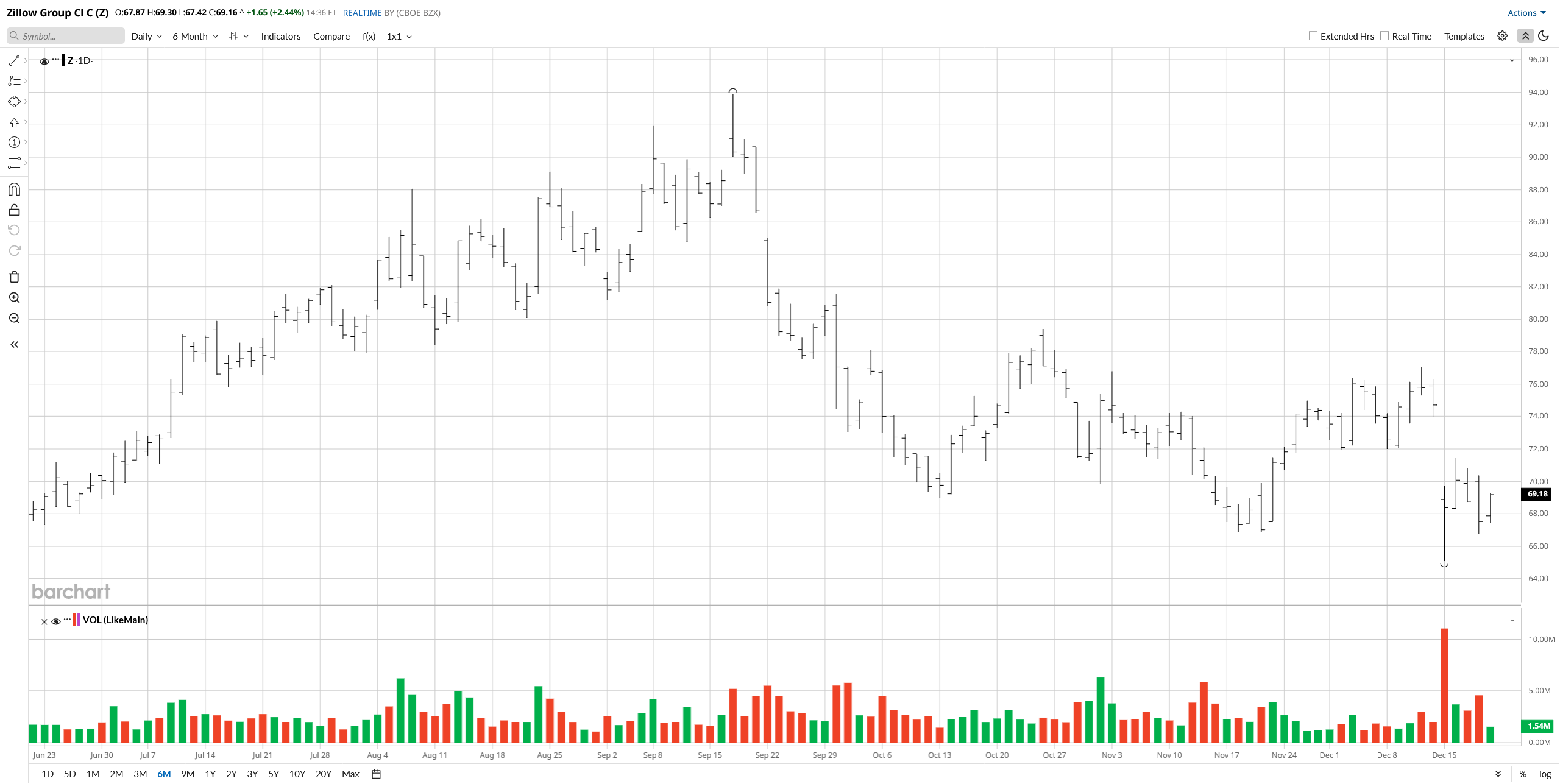

As of afternoon trading today, Dec. 19, Z stock has sunk 20% in the previous three months. Since the report of Google placing home-sale ads on its search results emerged on Dec. 12, Zillow's shares have dropped nearly 10%.

Zillow's price-sales ratio is 7.6 times, but its price-book ratio is only 3.4 times. Its market capitalization is $16.65 billion.

In the third quarter, its revenue rose to $676 million, versus $581 million during the same period a year earlier. Further, Z generated net income from continuous operations of $10 million last quarter compared with a net loss of $20 million in Q3 of 2024.

Alphabet's Ads and Their Potential Impact on Zillow

Apparently in partnership with a company called HouseCanary, Google tested the efficacy of placing home sale ads “directly into search results,” Mike DelPrete reported on Dec. 12. According to Seeking Alpha, DelPrete is “a real estate tech strategist.”

Canadian bank RBC Capital asserted that Zillow would be hurt by Google's initiative, but the bank does not expect the damage to be intense, since Google's move could run afoul of “Multiple Listing Service (MLS) distribution rules.” Consequently, Google may have to end the practice, RBC believes.

Similarly, Wells Fargo does not anticipate “a meaningful financial impact” on Z from the move, since Zillow gets relatively little of its traffic from organic search. Ultimately, Zillow and its competitors will have to engage in “bidding for home listing ad units,” but Google will not try to sell the ads to real estate agents, the bank predicted.

For its part, Bernstein in September upgraded Zillow to “Outperform” from “Market Perform” and hiked its price target on the shares to $105. The investment bank was upbeat on the company's revenue growth of around 15%, along with its Rentals and Showcase businesses. Additionally, Bernstein believed that Zillow's EBIT was nearing a positive turning point, while it would benefit from lower interest rates.

Housing Demand Looks Poised to Surge

Speaking of lower rates, the National Association of Realtors (NAR) recently predicted, citing lower rates and higher housing inventory, that home sales would surge 14% in 2026.

While some experts questioned whether the increase would reach 14%, most expect homes to become cheaper next year. Such a development should help boost demand.

And higher demand should spur more homes to go on sale, benefiting Zillow's main businesses.

On the date of publication, Larry Ramer did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Zillow Stock Plunged on Google Listing News, But 1 Analyst Still Thinks It Can Gain 50% from Here

- Netflix Stock Went from Boom to Bust This Year: How to Play the Stock for 2026

- As Intuit Jumps Into Stablecoin Business, Should You Buy, Sell, or Hold INTU Stock?

- ConocoPhillips Stock Still Looks 18% Undervalued - How to Play COP Stock?